DRAVANTI Middle East

Dravanti Middle East, known as “Dravanti”, “Dravanti Group”, or ‘DME’, is a commodity and real-world-asset (RWA) focused Virtual Asset Portfolio Provider. Dravanti offers a highly secure, stable, and scalable Virtual Asset investment vehicle, offering investors and owners of the Token access to a diversified RWA portfolio.

About Dravanti

Upon launching, Dravanti ME’s will harness ~$316m USD in Nickel assets, enabling the release of a fully compliant Security Token. Dravanti is partnered with MBME Group and Gulf Data International, allowing full integration of its Token across UAE payment infrastructure, and full AML/KYC as part of the customer on-boarding journey.

The Dravanti Token will be 1:1 wrapped to an ERC-20 token, allowing listing on Exchanges and unparalleled access to an asset-backed and stable RWA portfolio. Full KYC will be implemented through the Smart Contract, ensuring permissioned release of the ERC-20 tokens.

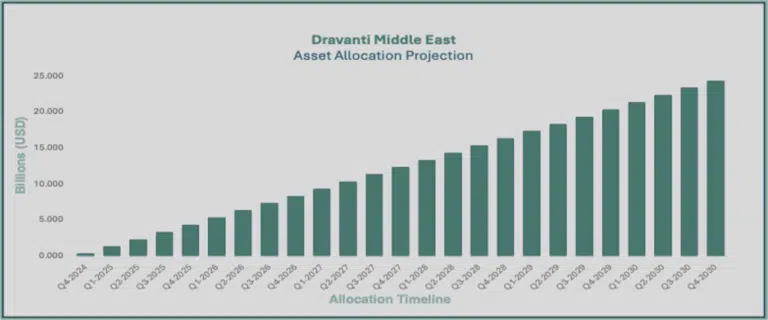

Post-launch, Inter-M Traders FZ LLE and Dravanti Middle East will ensure the alignment and release of further RWA, precious and semi-precious metals, ranging from between $300m to $1 billion USD allocated at the start of each financial quarter.

The allocation of assets will be based on market sentiment, allowing the phased release of assets. Dravanti Middle East will scale securely, reducing market risk while protecting both the portfolio and total circulating token supply. These measures, and strictly controlled liquidity, will allow Dravanti Middle East to scale one of the largest RWA portfolios in the world, offering all investor groups unparallelled access to liquidity and value.

Tokenization in the Market

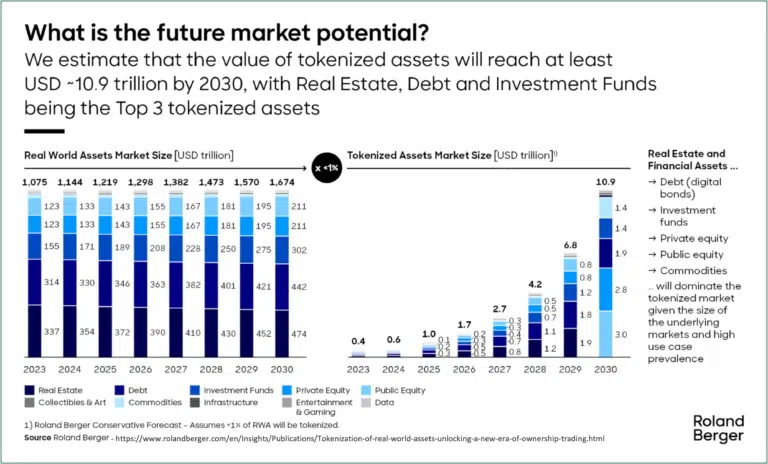

Real-world assets (RWAs) are the emerging, stable and scaling player in the on-chain financial ecosystem, shaping views on currencies, commodities, and equities. Emerging technologies, and a maturing regulatory ecosystem, are closing the gap between traditional investment structures, and new financial asset classes that provide increased accessibility and liquidity across multiple investment opportunities. There has been increased interest the Tokenization of Real-World-Asset commodities, across all commodity types, with large institutions moving on mass towards Tokenized RWA, as a secure, stable and recognisable asset class. This growth has fuelled the market presence of providers and services in the Real-World-Asset and Tokenization space; an ever-expanding range of asset classes are being placed on-chain, with RWA Tokenization pegged at the centre of an expansion set to be worth $16 Trillion by 2030.

ERC-1400 proposed as security token standard, following introduction of ST-20 by Polymath in February 2018

Various platforms and institutions explore security token standards.

Lorem

2018

> ERC-1400 proposed as security token standard, following introduction of ST-20 by Polymath in February 2018.

2019 - 2020

> Various platforms and institutions explore security token standards.

2023

> RedSwan CRE tokenizes $4 billion real-estate portfolio.

> Tokenized Gold Surpasses $1B in Market Capitalisation for the first time.

> JP Morgan debuts its Tokenized Collateral Network platform.

> ERC-3643 attained ‘Final’ status as security standard on Ethereum.

2024

> Office of the Comptroller of the Currency hosts RWA symposium (US).

> BlackRock announced RWA tokenization fund on Ethereum Network.

> Investcorp announces partnership Securitize.

> Mastercard announced vision for 100% e-commerce tokenization in Europe by 2030.

The future market potential of tokenization is expected to reach ~10.9 Trillion USD by 2030

Security

The Dravanti Token will be launched through a Security Token protocol, establishing high levels of trust and security, offering protection and stringent adherence to regulatory standards.

Stability

Dravanti will maintain significant asset reserves, only releasing liquidity as part of a controlled execution. Asset backing provides intrinsic value and stability to the Dravanti Token.

Accessibility

The Dravanti Token will fully integrate into MBME Group payment points across the UAE, accepting cash, Visa, Mastercard, and other digital payment solutions, such as Google PAY and Apple PAY.

Verification

Customer on-boarding will be managed by Gulf Data International, ensuring end-to-end AML/KYC, with additional features maintained in the Smart Contract ensure robust verification at all times.

Asset Management

Dravanti Middle East is backed and supported by Inter-M Traders FZ LLE, and its associated partners. Inter-M Traders FZ LLE will align fresh liquidity to the Dravanti Portfolio, comprising of multiple asset types and classes, on a quarterly basis, post the initial Token Generation Event.

Assets will be assigned based on market conditions, with enough liquidity and assets maintained at the Group level to ensure adequate portfolio stability, risk management and long-term investment scalability.

Compliance

- Places compliant and regulatory compatible protocols at its core.

- Integrates a Smart Contract wrapping to 1:1 the Security Token to ERC-20.

- Enables Exchange listing and functionality.

- Permissioned functionality within the Smart Contract.

Accessibility

- Accessible through thousands of Payment points across UAE.

- Universal access through Cash, Visa, Mastercard, Google Pay, and Apple Pay.

- Secure verification and Customer on-boarding allows novel payment methods, such as voucher/QR Code.

Security

- Dravanti Tokens are asset backed to enhance trust and stability of the portfolio.

- Quarterly asset allocations guarantee stable growth and investment value.

- Assets are fully valued, audited, secured and warehoused in tier 1 locations.

Asset

- Assets are fully owned by Inter-M Traders FZ LLE; fully audited, and secured across multiple sites.

- Assets received industry standard assurance and audit.

- Assets assigned to Dravanti ME portfolio as part of a predictable and stable alignment process.